Farmers are no strangers to risk. Each season, you manage countless variables outside your control—commodity prices, weather patterns, input costs—all while keeping a sharp eye on margins. Yet there’s a major financial risk that often gets overlooked: the cost of equipment failure.

In many cases, a major mechanical failure is the second-largest annual risk exposure on a farm, behind only yields and pricing. Unlike commodity markets or weather where we have tools like futures contracts and crop insurance, most farms don’t have a proactive strategy to manage equipment risk—at least not without buying new or near-new equipment. In today’s market, that’s a difficult strategy to execute.

Without the ability to consistently buy equipment with full base warranty, many have leaned heavily on something that’s quietly disappearing: goodwill from manufacturers and dealerships. In the past, when something failed just outside of base warranty, there was often help available. But that reality is changing fast. Manufacturers today are tightening their belts, and equipment dealers across the country are reporting the same thing: goodwill support from OEMs is dwindling or disappearing altogether. When a major failure happens outside of warranty, farmers and dealers are increasingly left holding the full cost.

Meanwhile, the cost of repairs including engines, transmissions, and hydraulic systems continues to climb. A single failure on high-horsepower equipment can easily exceed fifty thousand dollars. For any operation, its not good. For a young farmer trying to get ahead, an unexpected expense of that size can be a major setback. For farmers nearing retirement, it can jeopardize the nest egg they’ve worked decades to build.

What can be done?

It starts with recognizing equipment risk as a critical part of your broader risk management strategy:

- Evaluate and Streamline: In today’s environment of tighter margins, farmers are taking a closer look at cash flow and operating expenses. Strategic risk management should be viewed as an essential part of that process, helping ensure that dollars are being used efficiently while protecting against costly disruptions.

- Mitigate Unnecessary Risks: Just like crop insurance mitigates production risk and a sound grain marketing plan mitigates price risk, extended service protection plans can help mitigate equipment risk. When tailored correctly, these plans offer an efficient, cost-effective way to transfer major repair risk off the farm and onto a third party.

For years, a clear gap has existed in risk management for equipment owners. Even farmers who run their operations carefully can still be caught off guard by major mechanical failures—expenses that are hard to predict and even harder to absorb. As a result, many producers hesitate to capitalize on a good deal for used equipment, wary of the unknowns and the potential cost of a breakdown. But that hesitation can come at a price. When paired with the right protection plan, used equipment often delivers a stronger return on investment especially when your primary need is reliable horsepower.

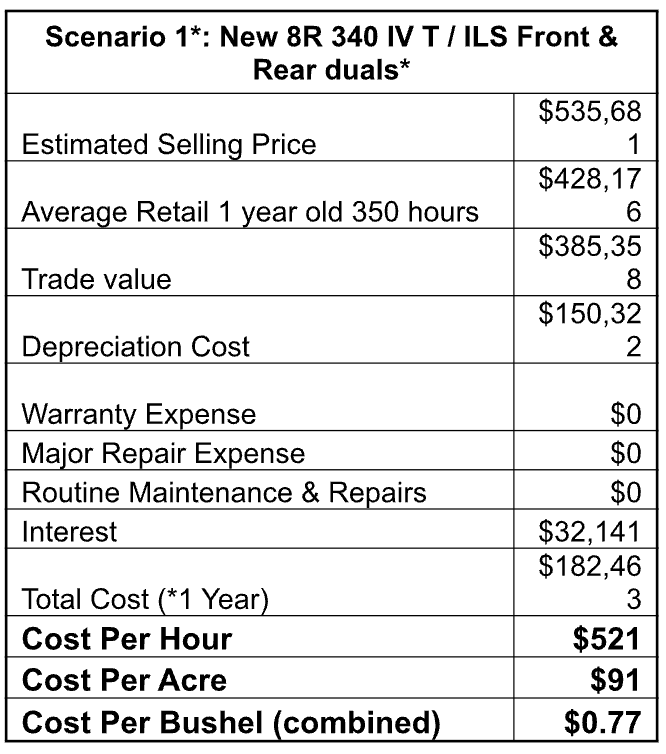

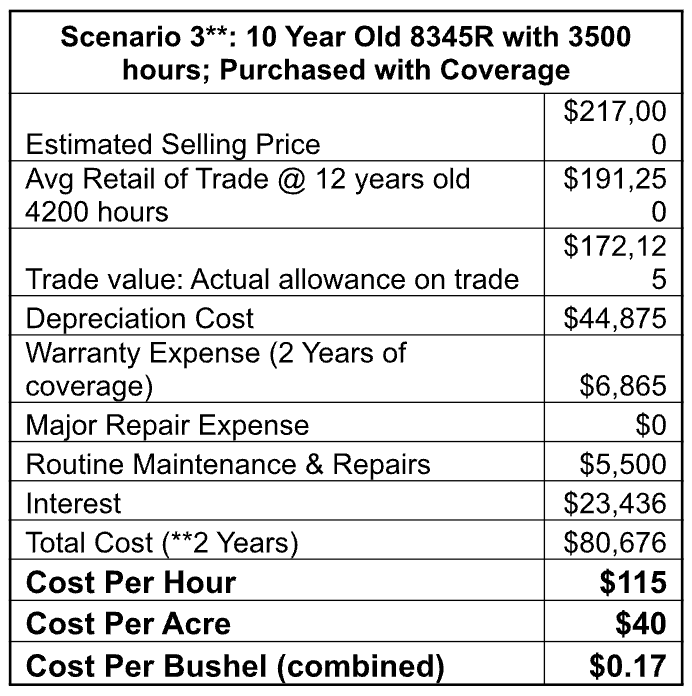

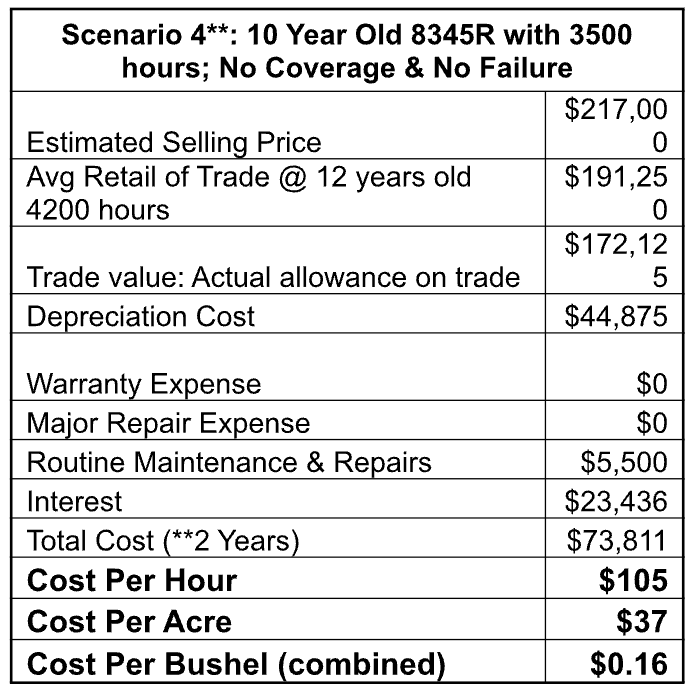

Consider the following scenarios for a 2,000-acre operation split evenly between corn and soybeans. With average yields of 190 bushels per acre on corn and 48 on soybeans, this hypothetical farm might evaluate several options to fill their need for a reliable row crop tractor that is expected to put on 350 hours per year:

Note: These scenarios are intended for illustrative purposes and are based on current market conditions and common industry practices. Every farm operation is unique and should use its own figures to accurately evaluate costs and outcomes. Additional factors—such as technology, fuel efficiency, varying interest rates, and local dealer support—should also be considered. The data reflects a John Deere 8R tractor equipped with IVT and ILS. The pricing used here represents typical retail conditions. Some operations may qualify for additional volume discounts on new equipment. The two-year trade cycle is more commonly applied to used equipment, and selling prices are based on objective, real-world data in today’s retail market. Depreciation outcomes will vary if the trade cycle is extended; however, doing so may increase maintenance and repair costs as well as aging technology.

The Bottom Line:

Managing risk in agriculture isn’t about avoiding every challenge because that’s simply not possible. It’s about making informed, strategic decisions that protect your financial foundation when the unexpected happens.

In today’s environment, relying on manufacturer goodwill or defaulting to new equipment purchases is not a reliable risk management strategy. Even if you choose not to add protection, it’s critical to understand what your equipment is truly costing you whether measured per hour, per acre, or per bushel in your break-even analysis.

Mechanical failures are a real-world risk—one of the largest annual exposures on most farms—and it deserves to be evaluated alongside the other risk management tools you already rely on, like crop insurance and grain marketing strategies. When you consider the cost and efficiency of transferring that risk, you might rethink the value that adding some coverage represents.

Farmers who take a proactive approach to equipment risk are positioned to invest confidently in the right machinery for their operation—and sleep better at night—no matter what the markets or the seasons bring. After all, preserving the family farm has always depended on preparation, perseverance, and forward-thinking decisions.

About the Author:

Jacob Bryce is the Founder and President of Machinery Scope, a company dedicated to helping equipment owners manage risk and avoid the financial disruption of major mechanical failures. With roots in their family farm operation near Glenwood, MN and years of experience leading used equipment sales for top dealerships, Jacob understands the real-world challenges that farmers face. That perspective led to the development of fair and flexible protection plans, including coverage options for equipment up to 15 years old. Jacob and the team at Machinery Scope have a passion for developing simple solutions to help equipment owners maximize their return on investment. Learn more at www.machineryscope.com.